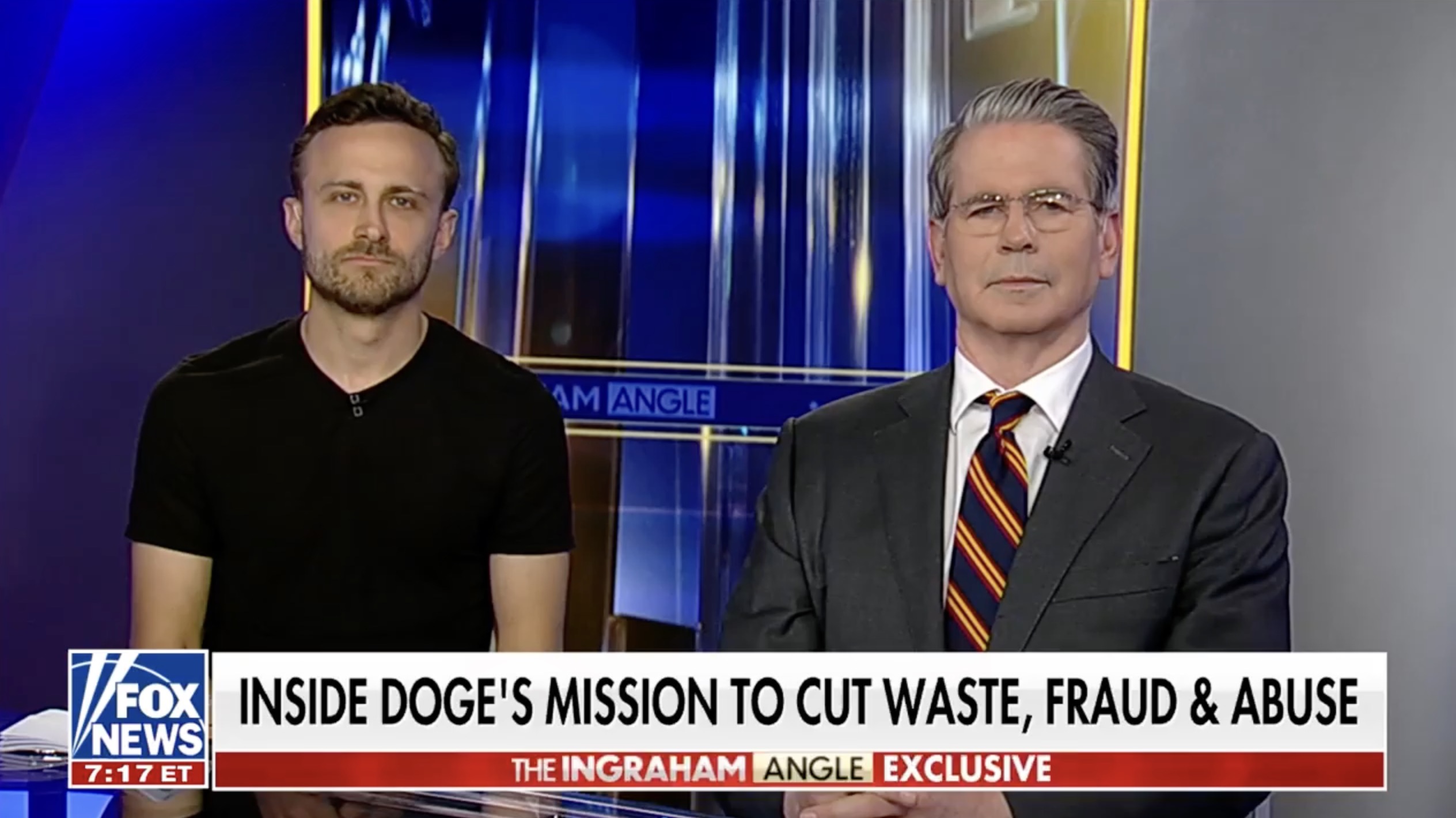

Sam Corcos, a DOGE deputy and special adviser to the U.S. Treasury Department, sat down with Fox News’ Laura Ingraham on Thursday and unloaded a jaw-dropping exposé on the IRS and Treasury.

Corcos, the co-founder and CEO of Levels—a health-tech company that uses real-time biological data to help people make smarter food choices—was brought in to assess the IRS’s so-called “modernization” effort. What he found? An unaccountable leviathan hemorrhaging of tax dollars.

“A huge part of our government is collecting taxes. We cannot perform the basic functions of tax collection without paying a toll to all these contractors. We really have to figure out how to get out of this hole. We’re in a really deep hole right now,” DOGE representative Sam Corcos said.

Corcos told Ingraham that one of his top priorities during his six-month tenure is to review the IRS modernization program, along with other operational and budgetary matters.

Corcos revealed that the IRS’s so-called modernization project is not only 30 years behind schedule, but also a jaw-dropping $15 billion over budget.

Sam Corcos:

Yeah, I’ve been brought in to look at the IRS’s modernization program in particular, as well as the operations and maintenance budget. I really care a lot about this country, and this is a huge program that’s currently 30 years behind schedule and already $15 billion over budget.Laura Ingraham:

Wait a second. Explain to our viewers what the program is in layman’s terms.Sam Corcos:

Yeah. The goal is to take… The IRS has some pretty legacy infrastructure. It’s actually very similar to what banks have been using—old mainframes running COBOL and assembly. The challenge has been: how do we migrate that to a modern system? Virtually every bank has already done this, but we’re still using a lot of those same systems.Typically, in industry, this takes a few years, maybe a few hundred million dollars. We’re now 35 years into this program. If you ask them now, it’s five years away—and it’s been five years away since 1990. It was supposed to be delivered in 1996, and it’s still five years away.

Corcos was trying to assess the system — but career bureaucrats, many of whom are terrified of accountability, resisted his efforts.

Laura Ingraham:

In your area of expertise, what informs your ability to do this review?Sam Corcos:

I’m a software developer by background, and I’m a CEO of a software technology company.Laura Ingraham:

When you came into the department, was the first thing you did to just get into the guts of the system and see how it operates?Sam Corcos:

Yeah, really talk to the software developers—talk to the people on the ground and see what they’re seeing. I think one encouraging thing is we actually have quite a lot of software talent on the ground—the people writing code. We actually have quite a lot of good people.It is almost always the case that when I ask them what the correct answer is, how do we solve these problems, they’re almost always right—which is good. They just haven’t been in a position to be empowered to make those decisions. I’m actually pretty optimistic that we can solve this.

WATCH:

For the FIRST time, a brave DOGE staffer is pulling back the curtain on just how broken the IRS really is

Sam Corcos, now a Treasury Dept. adviser, admits the truth:

IRS systems are 30+ YEARS OUTDATED…

$15 BILLION already flushed down the drain⁰— The Gateway Pundit (@gatewaypundit) March 21, 2025

According to Corcos, the IRS spends a staggering $3.5 billion annually just to keep the lights on—and 80% of that is funneled to outside contractors and licenses.

Sam Corcos:

It’s hard to really grasp the scale of this because we process at the IRS about the same amount of data as a mid-size bank. A typical mid-size bank will have somewhere between 100 and 200 people in IT, and they’ll have an operations and maintenance budget in the $20 million-a-year range.We have 8,000 people in IT, and our operations and maintenance budget is three and a half billion dollars a year. I don’t really know why yet, but I will tell you that 80% of that budget goes to contractors and licenses.

We cannot perform the basic functions of tax collection without paying a toll to all these contractors. We really have to figure out how to get out of this hole. We’re in a really deep hole right now. How do we turn this around?

We have a three and a half billion dollar operations and maintenance budget. We have a $3.7 billion modernization effort with MIT. That’s a lot of budget, and we are way beyond any reasonable cost for what you would expect of a private company.

When asked by Ingraham what surprised him the most upon stepping into the Department of Treasury, Corcos didn’t mince words.

Sam Corcos:

I would say it’s the disconnect between leadership and the people actually doing the work—that’s a big one. I would say that it doesn’t take a lot, just somebody who cares, to solve these problems. You find contracts that are $10, $20, $30, $50 million, and you just ask, “Why are we doing this?” And everyone’s just like, “I don’t know.” Then you cancel it, and nothing happens. Inertia has just taken over.

WATCH:

MORE – DOGE Staffer Drops Bombshell After Bombshell About Inner Workings of IRS/Treasury Dept.

DOGE insider Sam Corcos, special adviser to the U.S. Treasury Department, just unloaded a jaw-dropping exposé on the IRS and Treasury’s chaotic operations.

He’s pulling the mask off,… pic.twitter.com/GEG0jmtlQO

— Overton (@overton_news) March 21, 2025

The post DOGE Staffer BREAKS SILENCE on IRS Disaster: “30 Years Behind Schedule, $15 Billion Over Budget” appeared first on The Gateway Pundit.